value appeal property tax services

Typically property owners have 30-45 days from the time they receive their valuation notice to send a property tax appeal letter. Here at Tax Appeal Consultants we are passionate about Real Estate Property Tax Issues Property Tax Appeals and especially Property Tax Reductions.

The homeowners get their taxes reduced you have additional opportunities to make money and your colleagues are demonstrating their value to their clients by bringing this tax-saving opportunity to them.

. If you have value questions you may call 503 846-8826. They can help you assess the true value of your home and file an appeal to reduce your property taxes. Appeals of Property Assessment.

If not we are happy to answer your email or phone questions. Our property tax appeal services can help return significant property tax dollars to you. Because values are so high this year the tax rate will have to be reduced to remain under the 1 percent limit.

You shouldnt depend on your ability to fool people into giving you an appeal for your property tax assessment. Box 481 McFarland WI 53558 608-833-4528. This is where property tax appeal services can come in handy.

The Trouble With Property Taxes in the US. Have a Logical Case for Your Grievance. Contact Property Tax Service LLC PO.

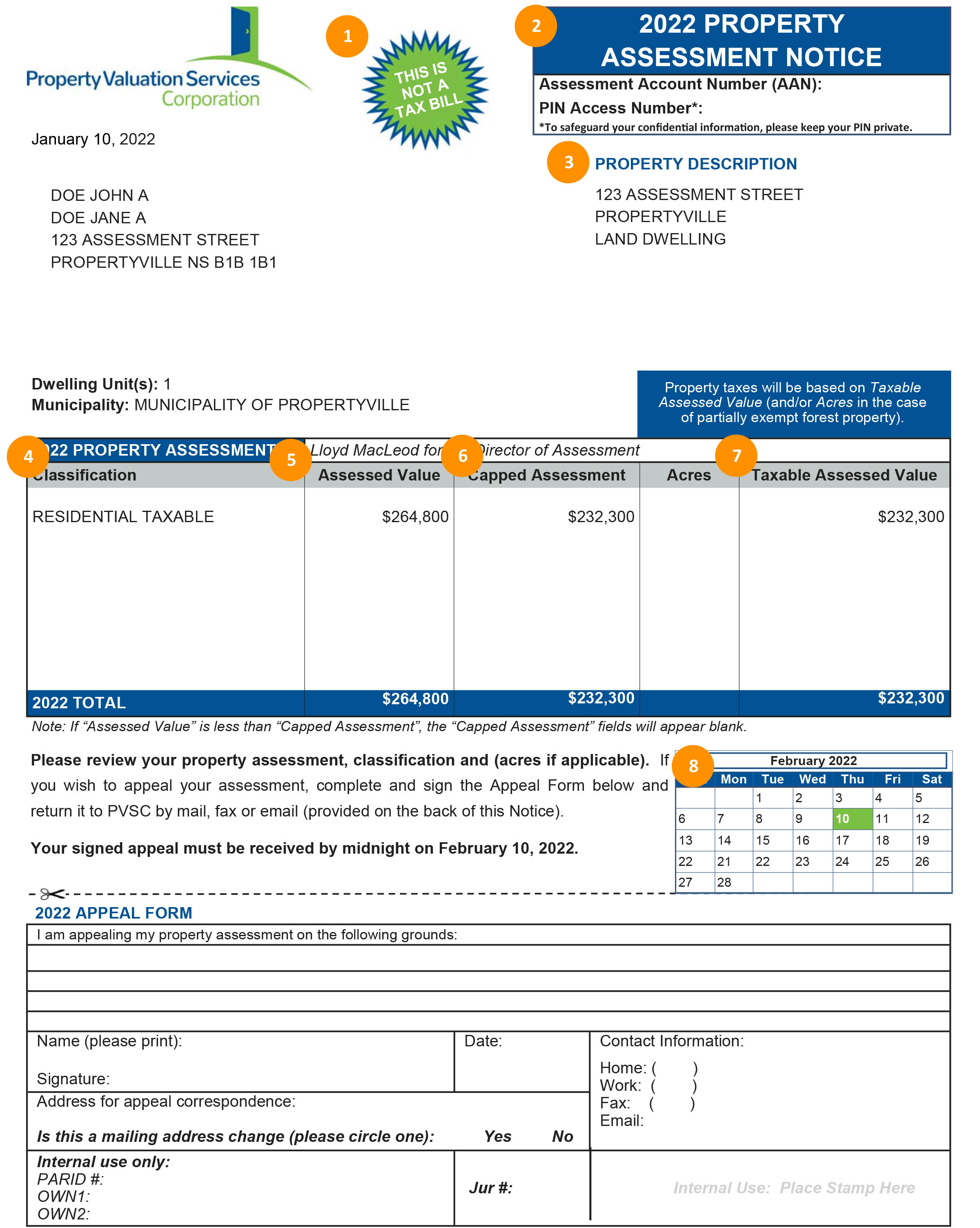

As soon as you receive your proposed property tax notification check your municipal or county tax assessors website to learn what you need to do next. Choose the options below that identifies your need and let Hoppe Associates assist you with your questions and property. When pricing your property tax appeal services consider your brokerage agreement.

Offers a variety of real estate appraisal services in Alessandro CA. OConnor will appeal your property taxes every year with no upfront cost or flat fees. Annual property tax appeals are necessary to verify the assessor is not assessing your home.

We are acting as Tax Agents in this service. The assessor must enroll the lessor of the two. So property values and property taxes are not directly connected.

1 in excess of market value or 2 higher than similar properties. Ad Lower your property taxes today - Guaranteed Savings No Up-Front Cost. If the assessed value exceeds market you are paying more than your fair share of taxes.

Check Your Property Tax Assessors Website. In contrast an appraisal is an unbiased opinion of value for which contingent fees are prohibited. PREPARING FOR YOUR ASSESSMENT APPEAL HEARING.

In addition to our appeals service we provide personal property form filing and property tax management services. A buyer that purchased a home in 2007 for 500000 would have a factored base year value of 500000 2 for each successive year. The Board of Property Tax Appeals BoPTA is comprised of independent citizens appointed by the Board of Commissioners.

Thats a relatively small windowwhich means you wont have time to confirm your belief that the assessed value is too high before notifying the jurisdiction you intend to appeal. The appeals board is an independent entity whose function is to resolve disputes between the county assessor and taxpayers over values of locally assessed property. Your interest in Reasons To Appeal Property Taxes indicates you.

Values are just one part of the equation. Hoppe Associates specializes in results-oriented property tax appeals. We save property owners time and money appealing property taxes.

Publication 30 Residential Property Assessment Appeals. Property tax appeal procedures vary from jurisdiction to jurisdiction. At NTPTS we believe that your property taxes should be equitable and based on the true value of your property.

TAX APPEAL CONSULTANTS provides no stress property tax appeal services for all types of real property throughout Southern California. They are authorized by law to hear appeals of your propertys value not the amount of tax you pay. The State Board of Equalization prescribes Property Tax Rules and issues instructional documents to assist.

There is an appeal process to assist property owners in presenting their concerns about property valuation. How to Prepare for a Hearing. Real Estate Tax Values And The Potential For Appeals After The Pandemic.

Mission Property Advisors Inc. The website should be clearly marked on your notification letter. If you feel like your tax payments have become too much to bear DoNotPay can help you understand how to lower them in a blink of an eye.

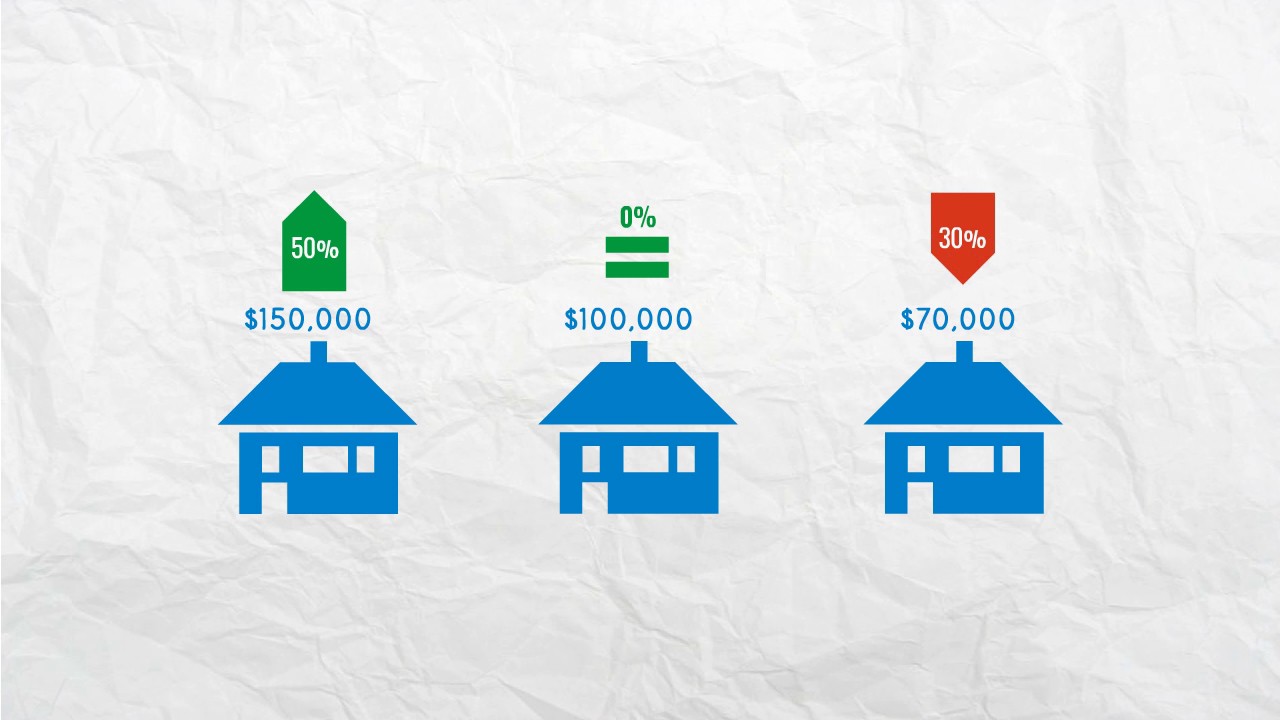

Washington State law requires the assessed value of a property reflect 100 of market value. We dont want you to pay more property taxes than you should be paying so if you think your. If everyones value increases about the same amount their piece of the tax pie remains about the same.

Residential Tax Appeal Services. The decisions of an appeals board are legally binding and enforceable. At Fair Assessments we have the knowledge experience and resources to successfully appeal a wide variety of residential properties.

Board members must make their decision based on the evidence. Our proprietary systems design enables us to capture the entire property tax process as well as provide administrative support for our clients. Hopefully you will find the information you are seeking about Reasons To Appeal Property Taxes.

Your Assessment Appeal Video. Depending on when a property is reappraised it can cause a commercial property tax value to increase. Real estate value appeals may be filed after January 1 and until the adjournment of the Board of Equalization and Review usually in May each year or within 30 days of any value change notification.

Price Your Services Properly. Appeals to the state board of equalization from a local board of equalization must be filed on. We monitor your property values applying our knowledge of.

Fair Assessments may lower your residential property taxes by reducing and capping tax assessments. An annual property tax appeal is important because assessors believe not. Daniel has 31 years of real estate valuation experience as a fee.

There is no cost to you. Taxable value of real property is determined by the Factored Base Year Value or current market value as of January 1 of that tax year. This way you can easily reference this information later on when it comes time to formally appeal your property value assessment with your local municipality.

Visit our website to learn more about our Tax Appeal Services. Vice President at Bayer Properties overseeing financial services for the commercial real estate portfolio. Appealing to the State Board of Equalization.

Just a portion of the savings. Daniel Jones handles all residential property tax appeals. We provide residential tax appeal services specializing in high-end residential properties in Dallas Collin Denton and Tarrant counties.

With limited exception a disputed assessment must first be appealed to the county board of equalization of where the property is located or it becomes final. Contact the assessor in your county to appeal to the county board of equalization. The year 2020.

Hotel Property Tax Consultant Springville Property Tax Commercial Property

Buying Vs Renting Commercial Property 4 Factors To Consider Rent Vs Buy Commercial Property Rent

Four Important Key Points To Lower Hotel Property Taxes Property Tax Property Property Values

Property Assessments Banff Ab Official Website

Property Tax Appeals When How Why To Submit Plus A Sample Letter

How To Know When To Appeal Your Property Tax Assessment Bankrate

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Your Property Assessment Notice Property Valuation Services Corporation

Pin By Cora Phillips On Cora Coding Tax Rate Property Tax

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Who Doesn T Want To Pay Less In Property Taxes Property Tax Tax Reduction Tax

Property Tax Appeals When How Why To Submit Plus A Sample Letter

15 Pro Tips For Appealing Your Property Tax Assessment Property Tax Grievance Heller Consultants Tax Grievance

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Marketing Real Estate Forms